- Home

- Hokkaido, Japan

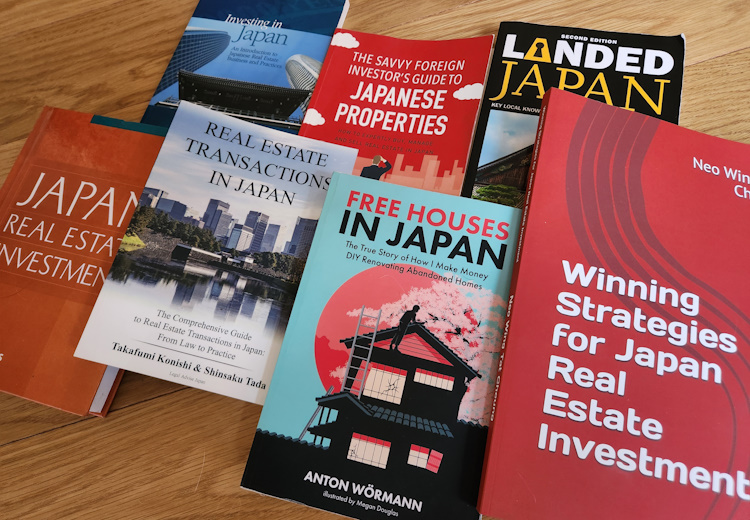

- Japanese Real Estate Books

Books about Real Estate in Japan

As a service to our clients, to students, and to professionals interested in Japanese real estate, we present our research on the best books about real estate in Japan. These books focus on Japan rather than any particular region, but wherever possible we have included details about Hokkaido real estate, as well as references to current trends and topics that we see with buyers and investors in the Japanese real estate market.

We open our research with this quote from Toshihiko Yamamoto (from his book, which is included in our list below):

Very few industry professionals are producing timely information about the property market in English for the public.

It seems wise to assume that the best books about Japanese real estate are most likely written in Japanese. While that is true, for investors that are not fluent in Japanese there is a practical need for information in English. Many of these books (some recent, some older) can provide insight Japanese real estate transactions.

While the internet has changed how real estate in Japan is presented and marketed, the Japanese lag behind many countries in bringing current real estate information and data in a format that is readable for foreigners. English language books about real estate in Japan remain surprisingly relevant, and almost always take us deeper than online-only sources.

Below we present several books from our review, with some of the best information “in print” on the process of buying real estate in Japan. For feedback or suggestions, please contact us.

English Language Japanese Real Estate Books

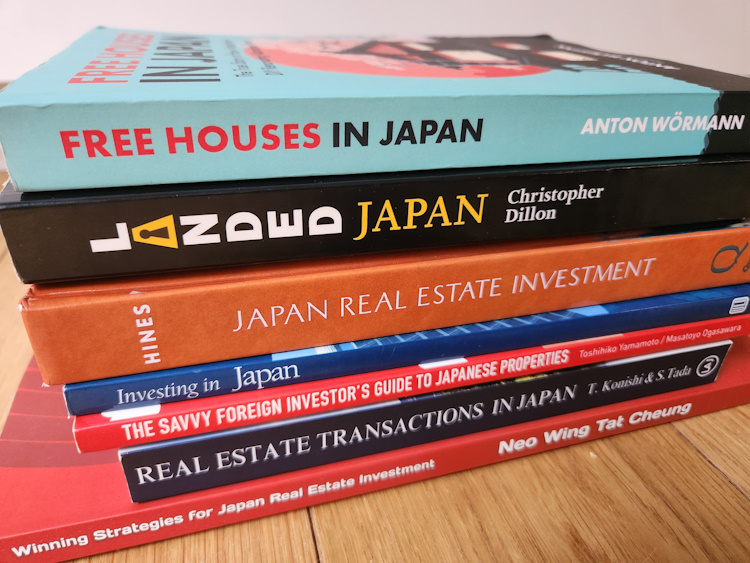

— Free Houses in Japan (2023)

— Real Estate Transactions in Japan (2023)

— Frontiers of Real Estate Science in Japan (2021)

— Landed Japan (2018)

— The Savvy Foreign Investor’s Guide to Japanese Properties (2018)

— Japanese Real-Estate Property Investment for Foreigners (2017)

— Winning Strategies for Japan Real Estate Investment: 日本不動產必勝法則 (2017)

— Legal Issues in Japanese Real Estate Investment (2012)

— Investing in Japan (2004)

— Japan Real Estate Investment (2001)

— Housing Markets in the United States and Japan (1994)

— Investing in Japanese Real Estate (1987)

Free Houses in Japan (2023)

Free Houses in Japan is perhaps the most famous book on the topic of abandoned akiya property in Japan. It tells the very personal story of how Swedish expat Anton Wormann has created a media sensation around his passion for renovating distressed homes in Japan.

By transforming abandoned houses into vibrant living spaces, we are not only generating remarkable returns on investment but also solving a societal problem.

The full title is Free Houses in Japan: The True Story of How I Make Money DIY Renovating Abandoned Homes. The books a mix of memoir of Anton’s time in Japan, and detailed “how-to” guide to buying, remodeling, and creating income from akiya. Wormann’s book is 334, with 19 chapters dedicated to helping foreigners explore the possibilities to buy abandoned akiya in Japan, to generate profit, and to improve the communities where these properties exist.

I told him I wanted to buy it. It was a crazy decision and I had literally no idea how huge this project was about to be.

In our full review of Free Houses in Japan, we provide several quotes from Anton’s story, along with our own take as real estate consultants on the topics he covers, including how to find akiya in Japan, why property listing websites in Japan are not the best way to find akiya, our suggested budget for buying akiya in Japan. Anton does a fantastic job of show how he has benefited from the talent of local real estate brokers in Japan.

While Free Houses tells a story that includes Anton’s earlier days as an investors in Japanese akiya, we found the book to be a very credible source of information for foreigners buying real estate in Japan. It’s both professional, and passionately written. For more quotes and analysis of akiya and Wormann’s book, see our full review.

Real Estate Transactions in Japan (2023)

Real Estate Transactions in Japan is an excellent book about the process of buying and selling Japanese real estate. While the book is both detailed and thorough, it is an instructive resource for the parties on both sides of a transaction. The authors cover a range of topics focused on the contracts and procedures involved in purchasing real estate in Japan. It is a great education, delivered in a format that is easy to read and understand.

With this book, even general readers who are not legal professionals can easily get an overview of the key legal and practical issues related to real estate transactions in Japan.

The full title is Real Estate Transactions in Japan: The Comprehensive Guide to Real Estate Transactions in Japan: From Law to Practice. The authors are Takafumi Konishi and Shinsaku Tada, both of which are attorneys with experience in real estate transactions in Japan. While the book is not a legal text, the authors have taken their knowledge of property sales, and have written a very thorough book that helps the reader to understand the goals of the contracts and the procedural steps in the sale of Japanese property.

Across 17 chapters (plus an extensive appendix), each role involved in a real estate sale (the buyer, the seller, the real estate agents, the judicial scrivener, the tax accountants, etc) is carefully reviewed with an emphasis on their responsibilities and contributions. The various documents involved in the sale are examined, and the various functions of those documents are explained. Each step in the sale of property in Japan is outlined, showing how the parties and documents interact with each other, and how those parties can work toward a sale that is both legal and meets the needs of everyone involved.

As the authors present and then revisit some of the same topics via various perspectives, the reader has a chance to both learn, and then review, the real estate sales process. While the book is not focused on the experience of foreigners buying property in Japan, there are several notes specifically included to educate foreign buyers.

In both the content presented and the production value, Real Estate Transactions in Japan is a very high-quality book, and offers readers an excellent opportunity to deepen their knowledge of real estate sales in Japan.

For more information, read our complete review of Real Estate Transactions in Japan, where we share some of the notes we took as we read the book, and expand on some of the topics from our experience with clients.

Frontiers of Real Estate Science in Japan (2021)

From New Frontiers in Regional Science: Asian Perspectives #29

By Yasushi Asami, Yoshiro Higano, Hideo Fukui (and others)

Frontiers of Real Estate Science in Japan (which is a series of articles or “papers”) was a surprisingly interesting resource we discovered in our research on the best Japanese real estate books.

It features carefully selected English translations of peer-reviewed papers and excellent articles published in the Japanese Journal of Real Estate Sciences, as well as papers presented at the Japan Association of Real Estate Sciences (JARES) annual conference.

Some of that description and the style of Frontiers of Real Estate Science in Japan appears to have an academic perspective. However, as we dug into some of the articles we found so much of the book to be interesting and informative, and very practical. The articles are written about Japanese real estate from a national perspective, but even buyers looking for homes in Sapporo will find topics to enrich their understanding of the market here in Japan; it was more relevant to the individual real estate investor than we assumed it might be.

From the website of the publishers of Frontiers of Real Estate Science in Japan:

Presents the latest real estate research in Japan. Explains the typical characteristics of the real estate market in depopulated areas. Discusses real estate regulation and policy in Japan.

Frontiers of Real Estate Science in Japan is a collection of articles organized by topic. Some of the chapters include: “Realities and Challenges of Land Issues in the Era of Depopulation” (by Shoko Yoshihara), “Introduction: Real Estate Tax System and Real Estate Market in Japan” (by Yoshiro Higano), “The Optimal Reform About Property Tax” (by Fukuju Yamazaki), and more.

Information on issues like real estate taxes in Japan is one of many good reasons to be interested in Frontiers of Real Estate Science in Japan.

For another particularly good example, there is a chapter on the dual agency practice in Japan; “Dual Agency, Commission Levels, and the Effect on Sale Price in Residential Real Estate Market: A Questionnaire Survey on Real Estate Brokers in Japan,” by Keiichi Shirakawa and Toshiyuki Okoshi.

The practice of dual agency in Japanese real estate (where an agent attempts to represent and take a commission from both the buyer and the seller in a real estate transaction) is both controversial and can have a real impact (often negative) for one or both parties.

In residential real estate market, agents have an incentive to steer their clients to their own listings or buyers rather than offering the best value transaction, which is derived from allowing dual agency and information asymmetry among buyers, sellers, and agents. We estimated the commission levels and sale prices of real estate brokers through a questionnaire survey and found that seven out of ten brokers are closing dual-agency deals and lowering sale prices.

We hear stories like this from our clients, about their experiences with the habits and practices of some Japanese real estate agents. We have written several times about how some Japanese agents will try to encourage you to buy property directly from them as the seller’s agent, encouraging the client to forego the opportunity to have their own agent. With our experience with US real estate sales, buyers would almost never consider buying without their own agent; in Japan it is more common.

There are articles about “Land Plots with Unknown Owners,” which address the topic of “akiya” or abandoned houses in Japan that might potentially be purchased for a low cost. We find this topic to be incredibly relevant in our work with clients, as we regularly receive requests from foreigners that want akiya in Hokkaido. We also recognize that few agents want to service those requests; there is some tension in the market place on that topic, certainly.

Another example was this article; “Requirements for the Application of Exemption from Real Estate Acquisition Tax Due to Purpose of Use,” by Nobuyuki Kobayashi. We have written about the real estate acquisition tax in Japan (which is like a “sales tax” for real estate) which can come as a surprise for buyers from countries that don’t have that kind of tax. There is in fact an exemption process (we have taken a client through that exemption process) and foreign buyers would benefit from an education on these topics (and potentially have some or all of that tax refunded).

Frontiers of Real Estate Science in Japan is available as a book, but is also available with full access from the Springer Publishing website.

Landed Japan (2018)

By Christopher Dillon

Perhaps the best known western author on the topic of real estate in Japan, is Christopher Dillon. His classic book Landed Japan (originally written in 2010) was updated in 2018. We have a copy of Dillon’s Landed Japan book in our library, and it has been our experience that his book was good for our education, and many of the topics addressed in those pages come up in our work in the real estate transactions here in Hokkaido.

As a westerner with real estate experience in Japan (and Hong Kong), Dillon’s writing caters to the experiences of foreign buyers and investors. While Dillon is a not a real estate professional, he brings his own personal experiences with buying property in Tokyo, case studies from other foreigners, and extensive research to the writing process.

We are especially interested in his notes about real estate in Hokkaido:

With over one-fifth of Japan’s land, Hokkaido is the nation’s largest source of agricultural products, including seafood, beef, milk and cheese, rice and vegetables. Tourism, forestry and food related industries play important roles in the economy.

Dillon’s Landed Japan is divided in 6 sections (People, Your New Home, Locations, Money, Special Cases, Resources) and 23 chapters. There are many notes we find that mirror our experiences of selling and buying real estate in Hokkaido as a foreigner.

In addition to property ownership, Dillon has a lot of notes on rental properties in Japan. Many of which helped us understand our early days renting an apartment in Sapporo, and then understanding issues as we bought our first rental properties in Hokkaido.

Renting a home in Japan is expensive. Before a tenant moves in, they pay up to 6 month’s rent… the need to pay key money and limits on landlord’s ability to raise rents (see below) discouraged people from moving.

Dillon’s comments about key money (one of the apartment fees in Japan) is an interesting insight. When we wrote our article about the cost to move into an apartment in Sapporo, we presented some case study work that comes to some of the same conclusions that you’ll find in Dillon’s book. His book contains additional insights about topics like guarantor fees for apartments that help newcomers and investors to better understand apartment rentals and sales in Hokkaido and greater Japan.

There is a specific chapter on Hokkaido in Landed Japan, one of six locations profiled in the book. There are also some specific notes on Sapporo real estate and a few other cities that remain the prime locations for real estate in Hokkaido today.

In 1970, Sapporo’s population surpassed one million for the first time. Today, Sapporo has 1.9 million people making it Japan’s fifth-largest city. The city continues to benefit from migration from other parts of Hokkaido.

In our recent work on the population of Sapporo, we provide more recent figures, as well as trends about foreigners living in Sapporo.

Other topics related to real estate transactions in Hokkaido that are discussed in Landed Japan include: Challenges presented by high condominium management fees or kanri-hi (what we would call HOA fees in the United States), foreign currency and the impact of changes in the value of the yen on real estate investment, the shinkansen in Hokkaido, Airbnb and minpaku in Japan, real estate in Niseko, the early role of the Australians investing in Niseko and the very real trend of property built to accommodate foreign buyers.

Japan offers a wide array of recreational property, ranging from ski chalets in the hills of Hokkaido to beachfront resorts in Okinawa. Much of this is new, expensive and built for international tourists.

Dillon manages to show how current trends that apply to foreign real estate investment in Niseko and Furano today might be equally true hundreds of miles to the south in Okinawa.

For more information and a deeper look, see our detailed review of Landed Japan.

The Savvy Foreign Investor’s Guide to Japanese Properties (2018)

“How to Expertly Buy, Manage and Sell Real Estate in Japan”

By Toshihiko Yamamoto, Masatoyo Ogasawara, and Douglas Jackson

Compared to some of the books on our list of Japanese real estate books, The Savvy Foreign Investor’s Guide to Japanese Properties is a relatively recent title. The book is intended to be practical, and is focused on foreigners that are interested in Japanese real estate. It is written in a causal, almost conversational style, full of anecdotes and a few light case studies.

One major problem investors from abroad face is a lack of information in English about this market… Foreign investors don’t know how the Japanese market works, what kinds of properties to look for, who to deal with (and who to avoid), source of financing or what yields to expect. This book looks to answer those questions and a great many more.

The Savvy Foreign Investor’s Guide to Japanese Properties is written by Toshihiko Yamamoto, a bilingual real estate broker with a degree in Economics from Japan and an MBA from an Australian university. He brings Masatoyo Ogasawara along as a partner, to add content on architecture, building, and renovation. They help clients negotiate and manage real estate in Tokyo, Japan.

Investors like the Japanese market because they know the legal structures are solid on ownership and so on, and the people involved adhere to them because everyone prefers a stable market.

The Savvy Foreign Investor’s Guide to Japanese Properties is divided into 10 chapters on topics including a Japanese real estate market overview, evaluating and managing properties, options for investing in Japan, property hunting tips, and some case studies involving renovations to property in Japan. Yamamoto also pulls quotes from reports from the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) from 2017 and another by CBRE from 2018.

While Japan’s overall population is decreasing, the number of households is rising, because a lot more people are living alone… actually creating more demand in property of a certain type.

Yamamoto is pointing to an interesting trend as he hints at how modern Japanese culture increases the importance of the one bedroom apartment (1LDK) in Japanese real estate.

Throughout the stories told in the book, there are several notes about financing, including comments about real estate loans for foreigners in Japan (including specific banks like Suruga Bank and Shinsei Bank). We conducted an extensive report on use cases where property loans for foreigners were feasible. While loans for property in Niseko (a popular request) are basically non-existent, we have specific experience with a foreign client (without permanent residency) successfully completing a loan with Suruga to purchase a residence in the Maruyama neighborhood in Sapporo; loans for foreigners in Japan are feasible, particularly in well established markets like Sapporo or Tokyo.

As of the time of publication of his book, Yamamoto likes akiya (potentially) as an investment. It is interesting to hear a real estate broker in Japan embracing the akiya strategy; the low purchase price and other challenges make akiya a controversial topic for many real estate agents here in Hokkaido.

I propose buying and flipping akiya into rental properties. These places are naturally very affordable… Here’s a simple strategy we recommend for this…

See our full review of The Savvy Foreign Investor’s Guide to Japanese Properties for more details.

Japanese Real-Estate Property Investment for Foreigners (2017)

“The Basics – what a first-time investor entering Japan’s property market needs to know.”

By Ziv Nakajima-Magen

Ziv Nakajima-Magen is a relatively well-known authority in terms of foreigners investing in Japanese real estate. We have personally had some interactions with Nakajima-Magen (and we liked him). He operates NTI (“Nippon Tradings International”), which he calls “a buyers’ agency & portfolio manager.” NTI is located in Fukuoka, Japan, but Nakajima-Magen is easily recognized as he has a podcast and writes often about real estate in Japan. Some topics you might see him write on include property investment in Japan for foreigners, issues with Japanese tenants, property management considerations, challenges with buying older condos in Japan, and more.

Here is a sample from Japanese Real-Estate Property Investment for Foreigners that gives you a sense of Nakajima-Magen’s perspective:

Japan’s got beautiful cash-flow, zilch to negative capital gain (recently that trend has changed, but no one knows how long this will continue), and the icing on the cake – the best and safest business and residential environment one could possibly hope for as a foreign investor or business person.

It’s a very practical book, and we can recognize the quality of his comments in our own experience with clients, and our own investments in Hokkaido property.

In a comment that caught our eye, Nakajima-Magen cites “shyness” as a reason why many foreigners can find it challenging to buy real estate in Japan.

The ethnocentric tendencies of the Japanese are well documented – they rarely speak English, almost never enough to conduct business in, and are extremely foreigner shy.

That is exactly our own experience, and was the principle reason we started Find Hokkaido Agents. As we introduce clients for property deals here in Sapporo, we find agents that can communicate in English, but will turn down deals they are prepared to service. It is not so much that the Japanese don’t like foreigners, it is a general reluctance to speak English (even when they are perfectly capable), a strong preference for working with other Japanese, and we agree that there is a “shyness” that keeps the Japanese from embracing more foreign real estate transactions.

Japanese Real-Estate Property Investment for Foreigners was first published in 2015 as an article, with his “part 2” (also published as an article) later that same year. We purchased our copy of Ziv Nakajima-Magen’s Japanese Real-Estate Property Investment for Foreigners – Part 1 as a Kindle ebook.

Winning Strategies for Japan Real Estate Investment: 日本不動產必勝法則 (2017)

By Neo Wing Tat Cheung, Mitsunori Hiraga, Makiyo Numada, Yoichiro Shojima (and others)

Checking in on Winning Strategies for Japan Real Estate Investment by Cheung and collaborators, an introduction to the book begins with:

Since Prime Minister Shinzo Abe took office in December 2012. The Japanese yen has plunged by 40 percent. Whereas the Nikkei 225 has surged more than 100 percent. In anticipation of the mega sporting events to be held in Japan such as the 2020 Olympic Games and 2019 Rugby World Cup, hot money from around the globe, including China, Hong Kong, Taiwan, and Singapore has been flooding into various Japanese asset classes including real estate. Unfortunately, information on Japan’s real estate has not been well circulated globally because of language barrier.

Since that was written, prime minister Shinzo Abe was tragically assassinated in 2022, and the pandemic caused the Olympics to be a disappointment (in terms of attendance and other potential), but much of the rest of passage is currently relevant. The value of the yen versus other first-world currencies is down, which does create incentives for foreign investment in real estate here in Japan. We see Asian foreigners with deep pockets buying property in Hokkaido (and Japan, on the larger level); strong economies in neighboring Asian countries are most certainly having an impact on sales of Japanese real estate.

The final comment in the quote about the language barrier is also entirely true. Even when doing business in your own language, building regulations, tax requirements, the complexities of contracts, all of it can be intimidating. When the language barrier means you can’t even read the documents, the process can seem more impenetrable, in some cases explicitly; many Japanese banks and institutions will require that you can read and speak Japanese on your own in order to even begin a transaction.

In our research for this post, we saw there was a previous digital version of Winning Strategies for Japan Real Estate Investment that was produced in 2015. Presumably the 2017 version serves as something like a second edition. Current reviews of the 2017 publication praise some of the information in Winning Strategies for Japan Real Estate Investment, but say the production value of the book is lacking.

For more details, read our full review of Winning Strategies for Japan Real Estate Investment.

Legal Issues in Japanese Real Estate Investment (2012)

By Jeff Wynkoop

Jeff Wynkoop is based in Tokyo, and is a real estate lawyer and investment professional, licensed in both the US and Japan. Wynkoop released his book Legal Issues in Japanese Real Estate Investment more than 10 years ago. He remains an active contributor to the real estate market of Japan, in his writing and as he works on real estate transactions. He has written recently (and extensively) on the topics of real estate prices in Japan, mortgage rates for property loans in Japan, changes in HOA rules that effect investment value of property condominiums, and more.

Do you need an in-depth explanation of Japanese real estate topics in English? Legal Issues in Japanese Real Estate Investment is a collection of twenty articles (plus a translation of the Real Estate Syndication Law) intended for both experienced real estate professionals and investors new to Japan.

Looking at Legal Issues in Japanese Real Estate Investment, Wynkoop’s focus seems to be more on real estate investment, and real estate as an investment vehicle, including REITs, and some discussion of real estate syndication in Japan.

The content is divided into 20 articles covering topics including “The Real Estate Transactions Law,” the famous “The Explanation of Important Matters” (that is read to you by a licensed real estate agent as a part of every real estate purchase in Japan), some information on transferring property and/or real estate loans, some comments on building codes in Japan, notes on leasing property in Japan, real estate investments types, specific notes on Japanese real estate syndication, comments on company formation in Japan and holding structures for real estate, and a final chapter on Japanese REITs.

Investing in Japan (2004)

“An introduction to Japanese real estate business and practices.”

By ULI (Urban Land Institute)

While the title Investing in Japan: An Introduction to Japanese Real Estate Business and Practices looks relevant, it was difficult to find much information about it online.

There are as many as three attributions as to the source of this book. Urban Land Institute is commonly associated with this title. The Takenaka Corporation (or Takenaka Kōmuten) is sometimes listed. And after some real digging, we came up with the name Graeme Browning as a possible author. It could be that the work is a collaboration of all of the above.

This practical hands-on tool will help you learn the ins and outs of purchasing, leasing, and renting property in Japan. Topics covered include: Japan’s real estate industry and foreign investments, appraisal, zoning ordinances and restrictions, leasing, negotiating for acquisition of property, recording property rights, taxes, financing and investing in commercial properties.

While the description calls it a “practical hands-on tool,” some reviews say it is more corporate focused, and less relevant for individual investors in Japanese real estate. When you see the emphasis on leasing and commercial properties, that might be true.

As for that author, there is a Graeme Browning that is described as a financial journalist, and he may (or may not) have written another book called, “If Everybody Bought One Shoe: American Capitalism in Communist China.”

We ordered a copy of Investing in Japan by Urban Land Institute, and when it arrives we’ll try to say more.

Japan Real Estate Investment (2001)

By Mary Alice Hines

Japan Real Estate Investment is the first of two books by Mary Alice Hines we feature here on our list of Japanese real estate books. We can’t be certain (as we don’t have a copy of her earlier book), but this seems to be an updated version of a previous work. The topic is the same, as is the volume of pages (336 in this update, versus 304 in the previous book).

MA Hines’ second book on real estate in Japan is still more than 20 years old, but could provide updated (and possibly more thorough) comments that build on her earlier writing. It is also easier to find, and less expensive to buy. Some universities have an online version.

Some of the chapters in Japan Real Estate Investment look promising, and could provide details that are relevant today. For example, “Land Development and Construction” and “Appraising Japanese Real Estate” probably have some continuity to today’s real estate business in Japan. However, other titles like “The New Investment Climate” and “Land Planning and Control: New Approaches” could be problematic, as they are said to be new, and are at least two decades old.

Along with books on other topics, M.A. Hines also wrote at least two books that were more broadly on international real estate, including A Guide to International Real Estate Investment in 1988, and then yet another book with a very similar title called Investing in International Real Estate in 2001. The timing for these titles show a similar pattern to her two Japan-focused titles; books published in the late 1980s, and then essentially republished under a slightly different name 10+ years later.

Housing Markets in the United States and Japan (1994)

By Yukio Noguchi, James M. Poterba

Released in 1994, Housing Markets in the United States and Japan is the second oldest book included in this list. It was published by the University of Chicago Press, as part of series from the National Bureau of Economic Research Conference Report (which is an American nonprofit research organization).

In this volume, ten essays discuss the evolution of housing prices, housing markets and personal savings, housing finance, commuting, and the impact of public policy on housing markets. The studies reveal surprising differences in housing investment in the two countries.

Chapters include Land Prices and House Prices in Japan, Housing Finance in Japan, Housing and the Journey to Work in the Tokyo Metropolitan, Housing and Saving in Japan, and others. Each chapter includes an equivalent chapter about the United States. At least 10 authors (approximately half of which are Japanese) contribute to this volume.

This book may be more academic (and policy focused) and less practical for individual investors. The age of the book will likely put it out of date in some ways (perhaps more so in the evaluation of American property than the Japanese side, which has changed more slowly).

Investing in Japanese Real Estate (1987)

By M.A. Hines

When you do research on books about Japanese real estate, M.A. Hines comes up very frequently. Investing in Japanese Real Estate, her first book specifically about real estate in Japan, came out in 1987.

Mary Alice Hines was an academic in the Real Estate and Finance school at Washburn University in Kansas, USA. She wrote at least two books about real estate in Japan. There are academic articles like “Appraising Japanese Real Estate” attributed to her in The Appraisal Journal from 1992. And she was still writing about real estate as late as 2003, but at that point, she was focused on Scottish/Irish real estate.

Investing in Japanese Real Estate (her first book about Japanese real estate) comes to 304 pages and was published in 1987. The book is still available for sale online, but is somewhat rare, and typically priced above $100 USD.

There are some quotes from an old review of Investing in Japanese Real Estate attributed to Mortgage Banking:

Hines, a noted authority and writer on domestic and international real estate, has conducted the first systematic research on this market and distilled her findings in one information-packed volume. M.A. Hines is convinced that to invest profitably in Japanese properties, the investor needs to develop an understanding not only of the investment market but of Japanese society, culture and economy.

As she seems to be broadly focused on real estate across countries, an academic (rather than someone focused on hands-on transactions), and this particular title is from the late 1980s, it seems that there could be better sources of information for buyers of real estate in Japan.

In fact, she wrote a second book with an almost identical title, that came out almost 15 years later – which seems like a better way to explore her research on property in Japan.

————————-

That concludes our list of the most significant Japanese real estate books written in English.

Over the course of our research on this topic, we have acquired several of these titles for our company library. As we spend more time working though these materials ourselves, our goal is to come back with specific reviews of these books to help share some of the perspectives and to help readers decide if they would like to learn more for themselves.

For comments and suggestions please contact us. We thank you for your attention and welcome your feedback.

We work for you, not the real estate companies.

We provide person-to-person introductions to prescreened agents that help you sell, buy, lease, or rent property in Hokkaido. We search our custom database to connect you to real estate professionals that speak your language, address your needs and are available now to help you find what you want.

Local. Trusted. 100% free to you.

To Get Started

- Contact Us or Call NOW:

Phone

- (+81) 50 5806-5302

- (+1) 833-893-0711

For More Information:

— Our collection of articles on real estate in Sapporo

— Some details on buying a house in Niseko and more

— Research on property in Otaru

— Review of Japanese property websites like SUUMO, HOME’S and At Homes

— More general articles about Hokkaido real estate

— Guide for How to Pay Property Tax in Japan and details about Tax Agents in Japan

— Some particulars on real estate taxes in Japan